You’ve picked your perfect group of partners and you’re looking to find that perfect home to share. Co-ownership, you’ve decided, is the way to go and, with everyone’s combined income and resources, getting a mortgage should be easy, right? Unfortunately, when it comes to co-ownership, getting a mortgage is a process that is more complex and takes longer than a regular mortgage.

This is Part 2 in our series where we break down the co-ownership process into 5 key steps that every group of partners has to go through in order to cooperatively purchase their home. In Part 1 we discussed how to pick your perfect partners. This article will cover the second step in the process: Building Your Financial Model.

Let’s Talk About Mortgages

Mortgages are a big deal. It’s a huge debt that you are agreeing to take on and that burden will be shared across your group. It is important, as with every step in co-ownership, that every person in your group needs to be on the same page. This step has no room for shyness or coyness. It’s time to open up fully and talk about your finances. GOCO calls it being ‘financially naked’ and it can be scary. Every single member of your group needs to open up and give a full financial history with no gaps because even the smallest discrepancies can have a huge impact on a mortgage application.

Part of being in a cooperative mindset and beginning the journey to co-ownership requires you to be financially ‘naked’ with your group. Every partner of the group needs to share with complete transparency their financial situation including their financial history, credit score and debt. This means even your personal consumer debt such as credit cards or personal loans. This can be scary and nerve-wracking and if you are unable to do this, you will not be able to successfully co-own a house. An application can be denied if one party member has a bad personal debt even if they have a good income. All your cards need to be out on the table before you even sit down in front of a lender.

Not all lenders are the same. They are all different and have different limitations. Most lenders allow for up to four people on the mortgage. There are few that will allow more. Some lenders will allow borrowed down payments while others will not. Some require credit scores that are higher than 680. Some lenders will not be comfortable lending to a group of strangers as they will sense a higher risk without family ties or common-law relationships. It can be difficult to navigate. Additionally applying for a mortgage with more than four people or larger homes or multiple units, application processing times will take far longer than a standard mortgage.

It can also be difficult to divide accountability when equity varies in a group. Now, this won’t be an issue for every group but some co-ownership situations will split equity variably which can mean that responsibilities among the partners are different. This is where being open and prepared at the beginning of the process will save you trouble down the line.

It would be easier if you and your group were able to split the mortgage equitably between yourselves as a ‘fractional mortgage’. Each partner would be responsible for their portion of the home. Unfortunately, there are currently no mortgage products that allow you to be responsible for only a portion of a home. To be on the title and claim ownership to a home, you must be on the mortgage which means you, and everyone else in the group, are liable for the entire mortgage payment. If one party member defaults, the burden falls on the group. It makes lenders hesitant especially when lending out to a group of strangers.

There’s no room to have separate mortgages either. Everyone who is on the title of the house needs to be on the same mortgage. However, while you can only have one single mortgage, it is possible, in some cases, to split the mortgage into separate products. For example, you could have a portion of the mortgage on a 3-year fixed rate while the other portion is on a 5-year variable.

Let’s Talk About Lenders

Let’s be honest - banks are not ready to embrace co-ownership and won’t have many favourable options for you. There are other options to pursue outside of banks though. Lenders who are more comfortable with the perceived risk of co-ownership and will offer far more favourable rates than banks. However, it must be noted that all lending institutions will have pros and cons. It is up to you and your group to decide which is best for you. Have a look at our table below.

Lenders ask for a lot of information when proceeding through an application for a house. Each and every co-ownership partner will need to have a full financial picture to give to the lender before the application even gets started.

You’ll need to be able to answer what you owe - be it debts, loans, credit cards, taxes or other mortgages, what your credit score and credit behaviour are like, what your down payment contribution is and where it is coming from and what your income will be.

It is key to work with your partners with full transparency to complete this process. As a group, you will have to have equity to make a down payment, income to pay the mortgage, taxes, utilities and expenses, and debt that needs to be accounted for in everyone’s finances.

A common mistake is to forget about your liabilities when going through a financial picture. Your income and assets are important but remember that consumer debt will affect how much mortgage your group will be allowed to take on.

Prior to going to a lender, your group needs to prepare. Each partner in the group will need to:

Check their credit score. If it is below 680, it will have to be improved.

Ensure all your taxes are up to date and paid

Do a budget

Determine how much cash and equity they can contribute to the down payments and closing costs

Determine their maximum monthly contribution towards the mortgage payment and property taxes.

Once this has been completed individually by all members of the group, then the group must come together and review. The review will:

Combine the histories and budgets into a group budget

Determine the group’s total available funds for a down payment and closing costs

Determine the group’s income for total monthly mortgage payments

Everyone needs to be on the same page and they all need to be financially naked. GOCO recommends everyone to be frank about everyone’s comfort with risk to help smooth the process.

So What Does All This Look Like?

Getting a mortgage is no simple process and with co-ownership, the process is more difficult and far longer than standard mortgages. Luckily for you and your group, GOCO is here to help you. Before you even sit down in front of a lender, your group needs to come together and get ‘financially naked’.

The most important activity in this step is to have each and every member of your group perform a full financial background and health check individually and then have your group meet and completely share their findings. Once this is done, then the financial model of your group can finally be developed and built. You and your group can develop a more accurate budget based on the different attributes of each group.

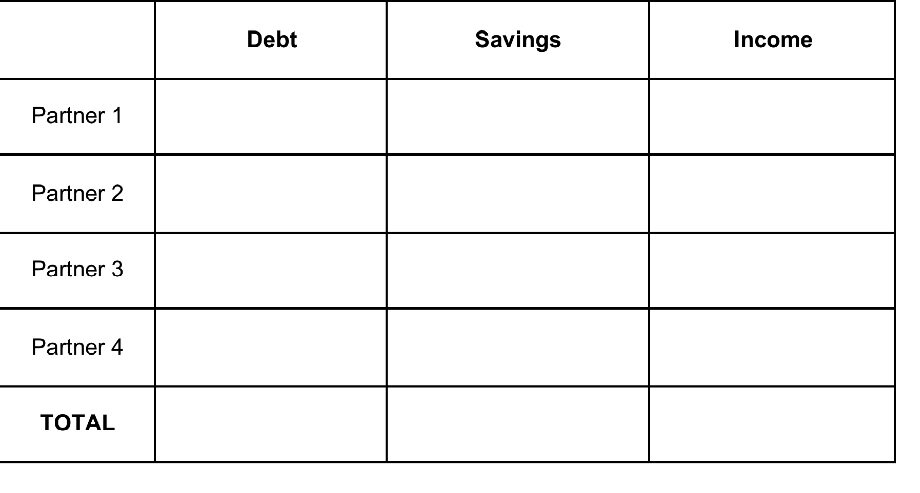

GOCO helps facilitate and assist with this step with a number of activities and resources. Let’s have a look in more detail about how this looks. Firstly, you and your group members create your own financial pictures. Here’s a little example in the table below.

This is important because it allows you to determine how much you contribute in cash and equity to the down payment and closing costs and what your maximum monthly contribution to your mortgage payment and expenses can be.

After you’ve sat down with your group and each reviewed your financial pictures, you can then combine everyone’s histories and budgets into a full group budget which will allow you to determine your available funds for the down payment and closing costs as well as your total group income for the monthly mortgage payment and expenses.

To simplify, you could put it into a small table such as this.

This will give you the basis of what you are working with towards understanding what you can afford.

Now we can COMBINE-LEVERAGE-SPLIT as you are buying as a group. Your group combines funds to increase the percentage of the down payment, leverages everyone’s income to increase the property value your group qualifies for and splits the monthly housing costs to make ownership more affordable.

Suddenly things like closing costs and fees aren’t as daunting when you can leverage and share them across the group. Additionally, you can divide the share between your partners based on the financial pictures each partner presented. This allows the burden to be shared based on what each individual member can afford.

Let’s look at an example of a group of four looking to purchase a home with a price tag of $2.2 million in Toronto. In this example, one of the parties requires renovations to occur to make the space livable. Additionally, the group is split three ways: a couple and two singles. Their financial picture looks like this.

Now, let’s have a look at the closing costs of the property and mortgage.

Now, let’s look at how the group is able to COMBINE-LEVERAGE-SPLIT.

This is one of the great ways that co-ownership can allow people who could not afford to purchase a home individually to be able to enter the real estate market with a group and share the burden of costs. Now keep in mind that this is a simplified example. Based on the groups’ individual savings, only Partner 2 can afford the down payment funds. But, Partner 2 will not be able to continue with the monthly mortgage payment. But, as a group, Partner 2 can support the down payment, in exchange for a smaller amount of the monthly mortgage payment.

That’s All Step Two?

As with every step in this process, there’s a lot to do but GOCO is here to help you. It might seem daunting but the payoff is worth it. Being open and financially naked with your group is scary but as long as you’re all in the co-operative mindset and focused on the goal of co-owning a home, you and your group will be successful.

Our next episode will discuss how to create your house rules. Stay tuned!

Thanks to Freepik for the graphic header.